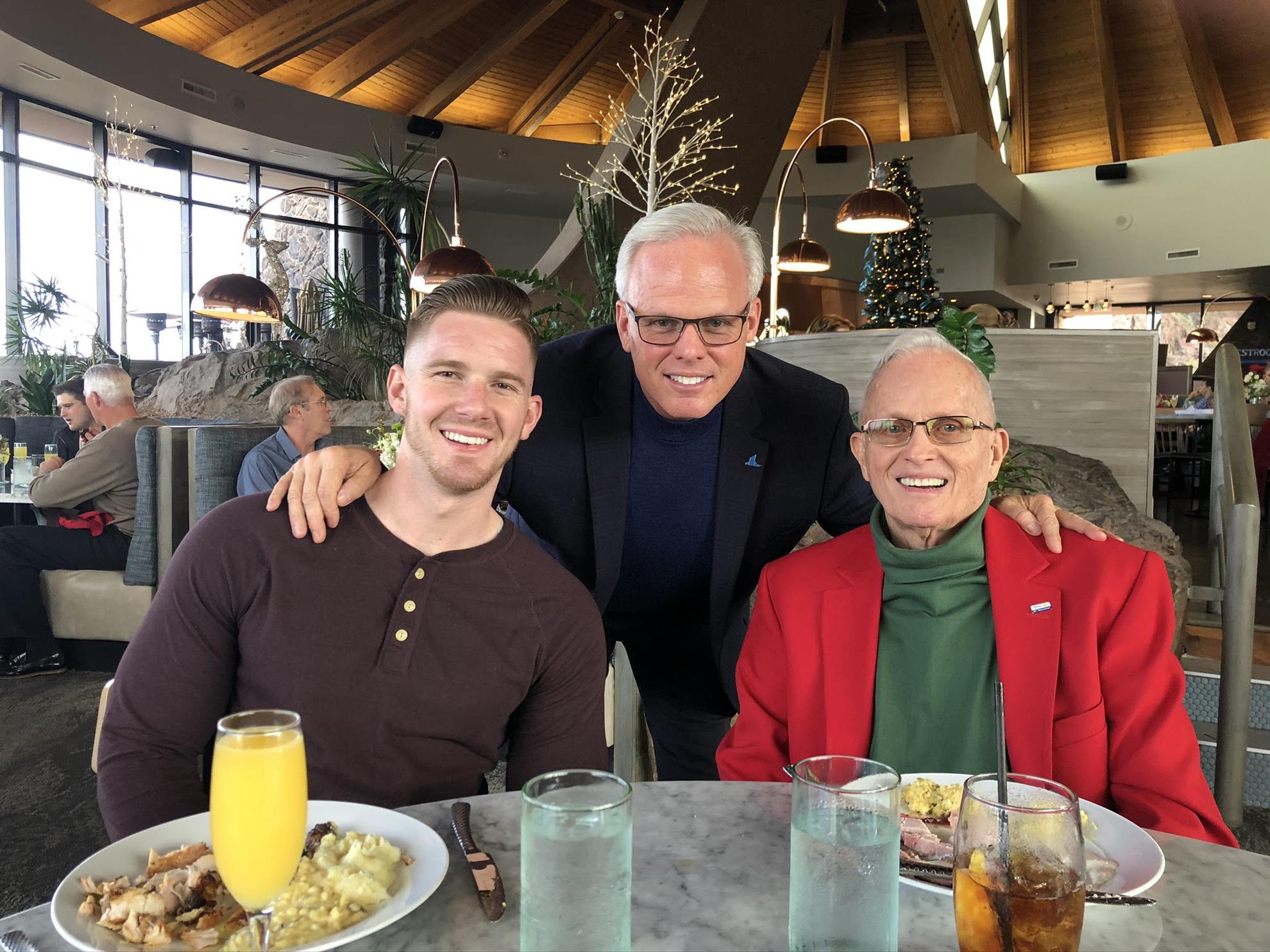

Jim Patmos, shown on the right in this photo serves as an advisor to The Rotary Vocational Fund of Arizona (TRVFA). He first joined Rotary 54 years ago in Grand Island New York. Both his maternal grandfather and his father were Rotarians and Jim remembers visiting their clubs with them as a young man. Jim's son Brent (middle in the photo) is a Rotarian. Jim has a granddaughter who became a Rotarian when she was about twenty-seven making them a five-generation family of Rotarians. Brent's son Bryce (on the left in the photo) is not a Rotarian yet - but it is only a matter of time... All three - Jim, Brent, and Bryce - have each already made a TRVFA donation this Rotary year. Jim moved his membership to the Oro Valley Rotary Club when he moved to Tucson in 1993. In 1995, he took over as chairman working with vocational schools and TRVFA grant candidates in his area. After a couple of years functioning in that capacity, Jim got acquainted with Roger Bonngard, who was on the TRVFA board and had been involved during its formative years, They met at a Rotary event even though they were each in separate districts at the time. Not long after Jim and Roger got acquainted, Jim was invited to join the TRVFA board. He served as a director from 1999 to 2006. Jim has been a member of the Chandler Horizon Club since 2003. For several years following his TRVFA board service, Jim was very involved with the Rotary International Peace Centers and their scholars. As career educator who had the best of both worlds, working both in administration and as an instructor, education has long been a passion. Attending sessions at RI conventions where he heard peace scholar presentations made him aware of the profound difference what was being taught at the Peace Centers could have on our world. Jim is also a supporter of The Rotary Foundation. As a result of his involvement with the Rotary Peace Centers, he and his wife have donated enough to be members of the Arch Klumph Society and have made funding of Peace Center scholars their fund's focus. One of the secrets to being able to be that generous was something he learned early in life. He began at about age ten to save and invest. No matter how much or how little he made, he always saved something. He studied and invested and says he was either lucky or good (maybe a little of both) but it all worked out for them. Jim says the Patmos family has a family meeting once a year - this year it was virtual. It is a very intentional discussion about the mark he hopes their family will leave on the world. It is a communicated expectation that young members of the family will seek a Rotary club to be a part of when they are around age 30. The kind of difference the family hopes to make in the world can best be achieved through the Rotary structure and the combined donations of time, talent, and treasure of 1,200,000 Rotarians worldwide. Jim would love to see other Rotarians grow future generations of Rotarians by educating their family as they have very intentionally done in the Patmos family. As a fellow-member of the Chandler Horizon Club with his long-time Rotary friend, Roger Bonngard, Jim frequently has the opportunity to be a part of the interview process for TRVFA applicants seeking their club's sponsorship of their grants. Jim says he learned long ago not to judge why or how the applicants might have found themselves in difficult circumstances, but to applaud their determination to overcome their situations through vocational education. Watching them successfully turn their lives around has been inspiring. Jim has been particularly proud of TRVFA's contribution to helping Arizona get through the COVID pandemic. The majority of grant recipients go into health-care vocations, and many are serving on the front lines. He believes many of the health-care workers involved in the mass effort to immunize Arizonans may well have been TRVFA grant recipients. Jim has a hard time understanding why any Arizona Rotarian would not support TRVFA. With the tax credit, it doesn't cost anything to make a huge difference in someone's life and there is a ripple effect with each life that person touches. CLICK HERE to go to the TRVFA donation page and accept Jim's challenge to "just do it!" |